Physical Address

W Sunrise St, Bisbee, Arizona 85603

Physical Address

W Sunrise St, Bisbee, Arizona 85603

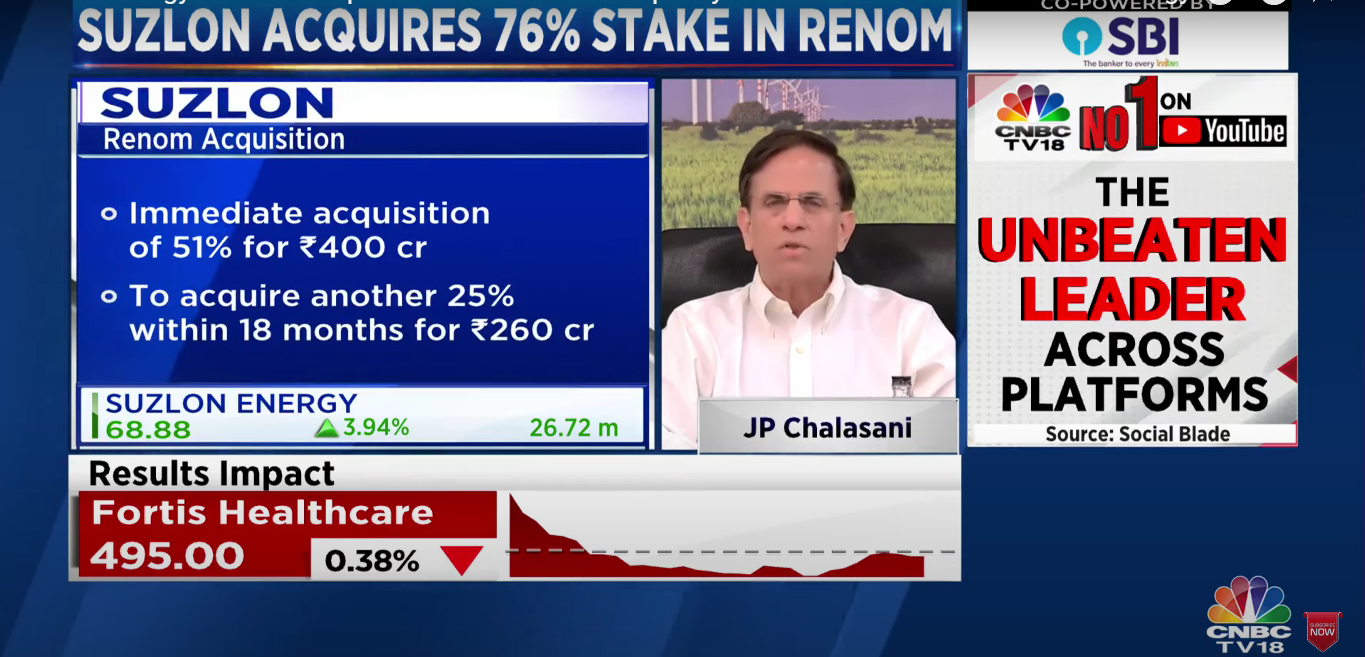

Suzlon Energy, a pioneer in India’s renewable energy sector, has recently made headlines with its acquisition of a 51% stake in Renom Energy Services, India’s largest multi-brand renewable energy operations and maintenance (O&M) service provider.

This strategic move, valued at ₹400 crore, is part of a larger plan to acquire a 76% stake in Renom over the next 18 months, with the total deal amounting to ₹660 crore.

This strategic acquisition will help unlock Renom's core potential to become a leading custodian of multi-brand renewable energy assets and leverage the massive opportunity of targeting over 32 GW of non-Suzlon wind energy assets in the country today.

— Suzlon Group (@Suzlon) August 7, 2024

Know more:… pic.twitter.com/gtX49IEe3H

Acquisition Structure:

Renom’s Assets Under Management:

The Suzlon Group has inked the acquisition of Renom, a Sanjay Ghodawat Group company and leading Independent Service Provider in India. Renom has almost a decade of experience in maintaining multi-make wind turbines. The company will operate independently and exclusively focus on… pic.twitter.com/n97TQhAD2o

— Suzlon Group (@Suzlon) August 7, 2024

Suzlon’s acquisition of Renom is a significant step towards strengthening its foothold in the Indian renewable energy sector.

Here are the key strategic reasons behind the acquisition:

Renom operates as a multi-brand O&M service provider, managing a vast portfolio of wind and solar assets. This acquisition allows Suzlon to tap into the non-Suzlon wind turbine market, which comprises approximately 32 GW of installed capacity in India.

The acquisition is expected to create substantial synergies between Suzlon and Renom. These include cross-leveraging projects, talent, and systems, as well as optimizing processes across both companies. This strategic alignment will help Suzlon enhance its service offerings and operational efficiency, positioning Renom as a leading independent service provider (ISP) in the industry.

Suzlon’s existing O&M business, which focuses on its own fleet of wind turbines, will be complemented by Renom’s expertise in managing non-Suzlon assets. This combined strength will enable Suzlon to capture a larger share of the O&M market, which is expected to grow significantly as India targets 100 GW of wind energy installations by 2030.

The financial implications of this acquisition are noteworthy. Suzlon’s stock reacted positively to the announcement, with shares rising by nearly 4% on the Bombay Stock Exchange. The acquisition also enhances Suzlon’s market capitalization, which stood at approximately ₹93,709 crore at the time of the announcement.

The table below summarizes the key financial details of the acquisition:

| Aspect | Details |

|---|---|

| Initial Stake Acquisition | 51% for ₹400 crore |

| Total Stake Acquisition | 76% for ₹660 crore |

| Assets Under Management | 1,782 MW Wind, 148 MW Solar, 572 MW BOP |

| Market Cap Impact | Increased by ~4% |

| Strategic Synergy | Expanding O&M services, operational efficiencies |

With India aiming to achieve 500 GW of renewable energy installations by 2030, this acquisition positions Suzlon to capitalize on the growing demand for O&M services across various renewable energy assets. The partnership with Renom also allows Suzlon to diversify its revenue streams and enhance its competitive edge in the rapidly evolving renewable energy sector.

Suzlon’s acquisition of Renom is gainful for both companies. This will give Suzlon a comprehensive presence in the non-Suzlon wind energy services segment.

— Suzlon Group (@Suzlon) August 9, 2024

Know more: https://t.co/MYmIUeksuk@Chalasani_j @tanti_girish @himanshumody @shrenikghodawat#Suzlon #Renom #multibrand

Suzlon’s acquisition of Renom is a strategic move that not only expands its market presence but also strengthens its operational capabilities. This acquisition is expected to create significant value for both companies, positioning them to lead the Indian renewable energy sector in the coming years.

By aligning with Renom, Suzlon has taken a crucial step toward its goal of becoming a comprehensive service provider in the renewable energy space, catering to both Suzlon and non-Suzlon assets alike.